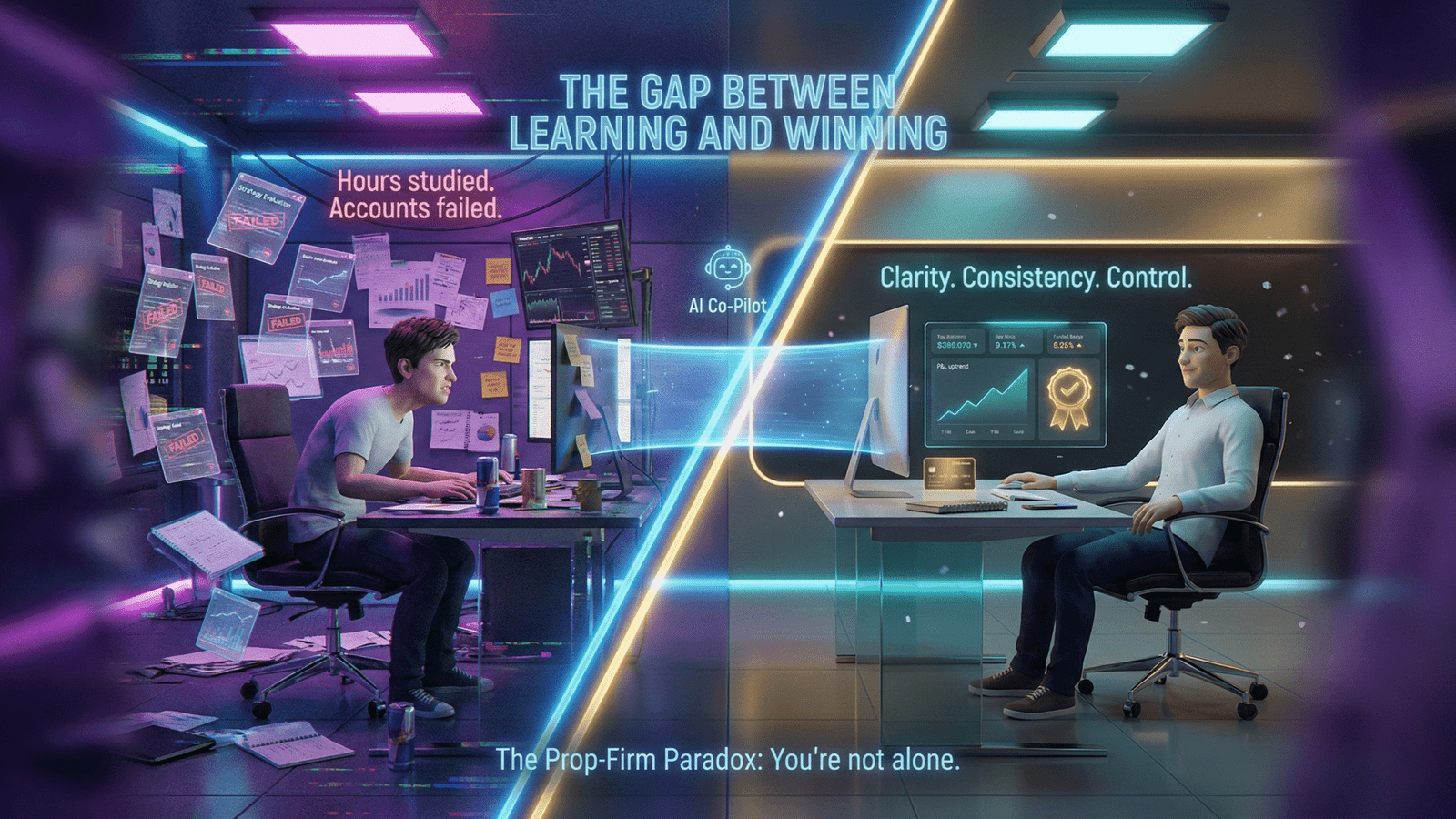

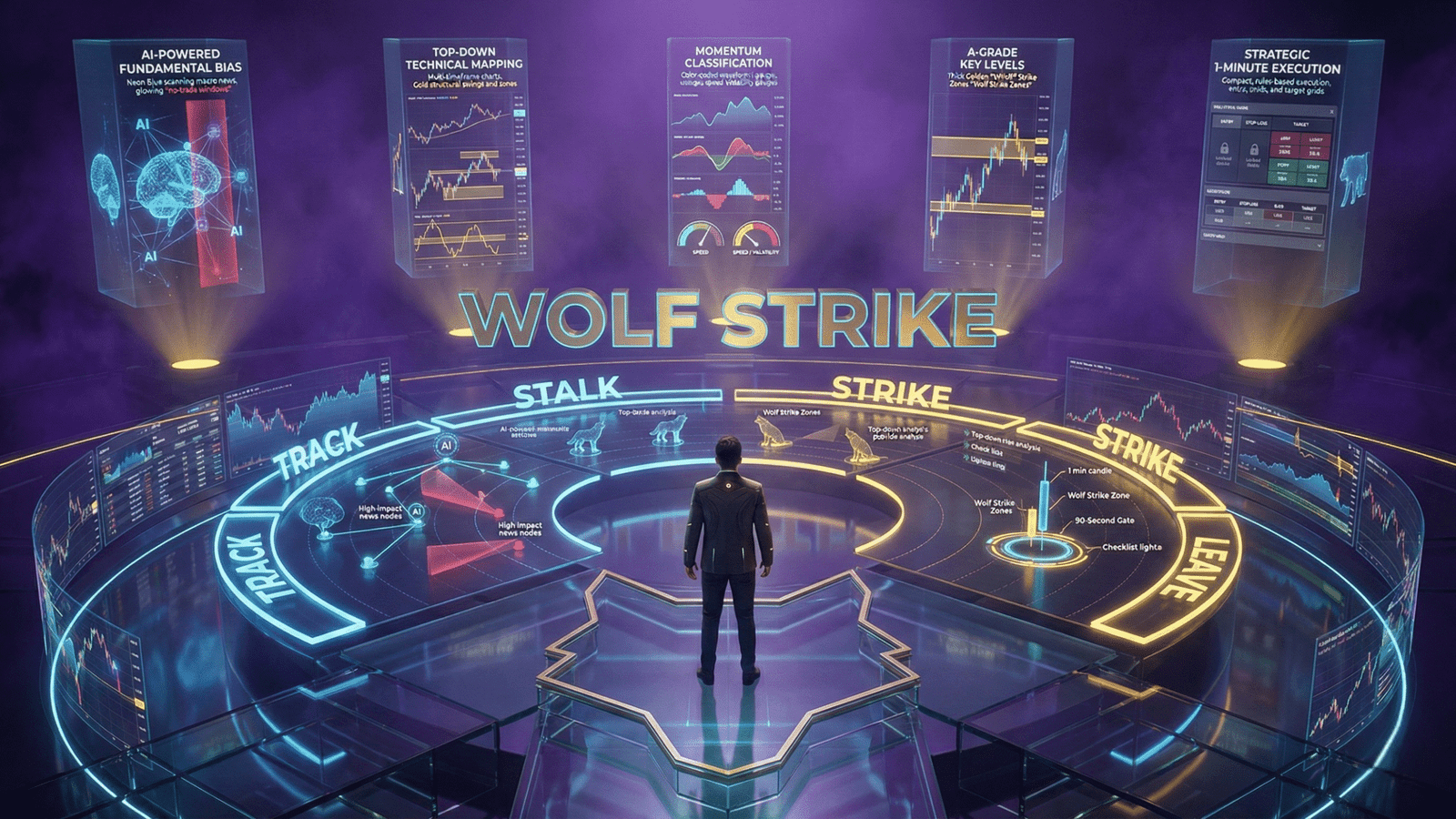

The Knowledge-Execution Gap

The Knowledge-Execution Gap

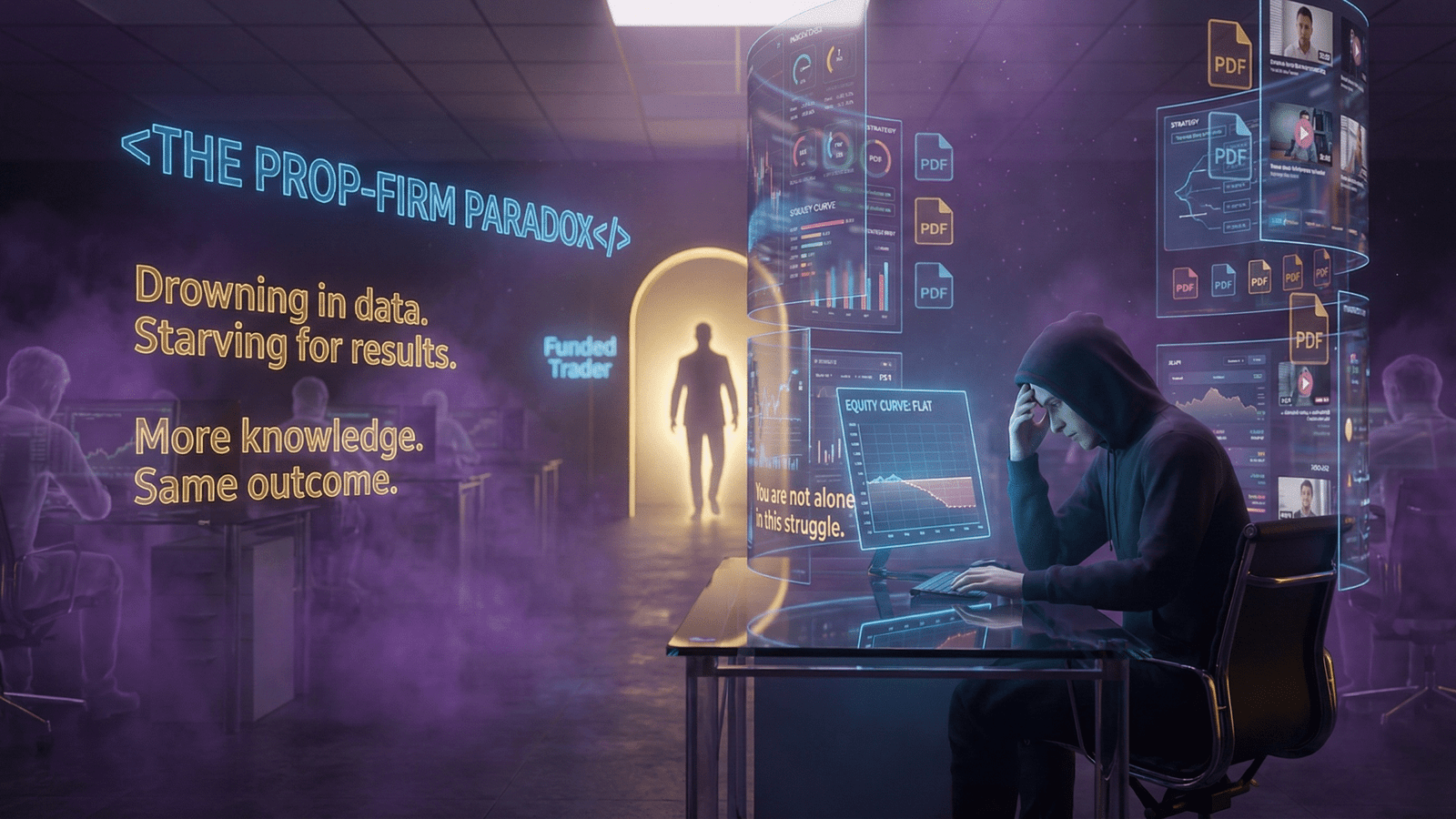

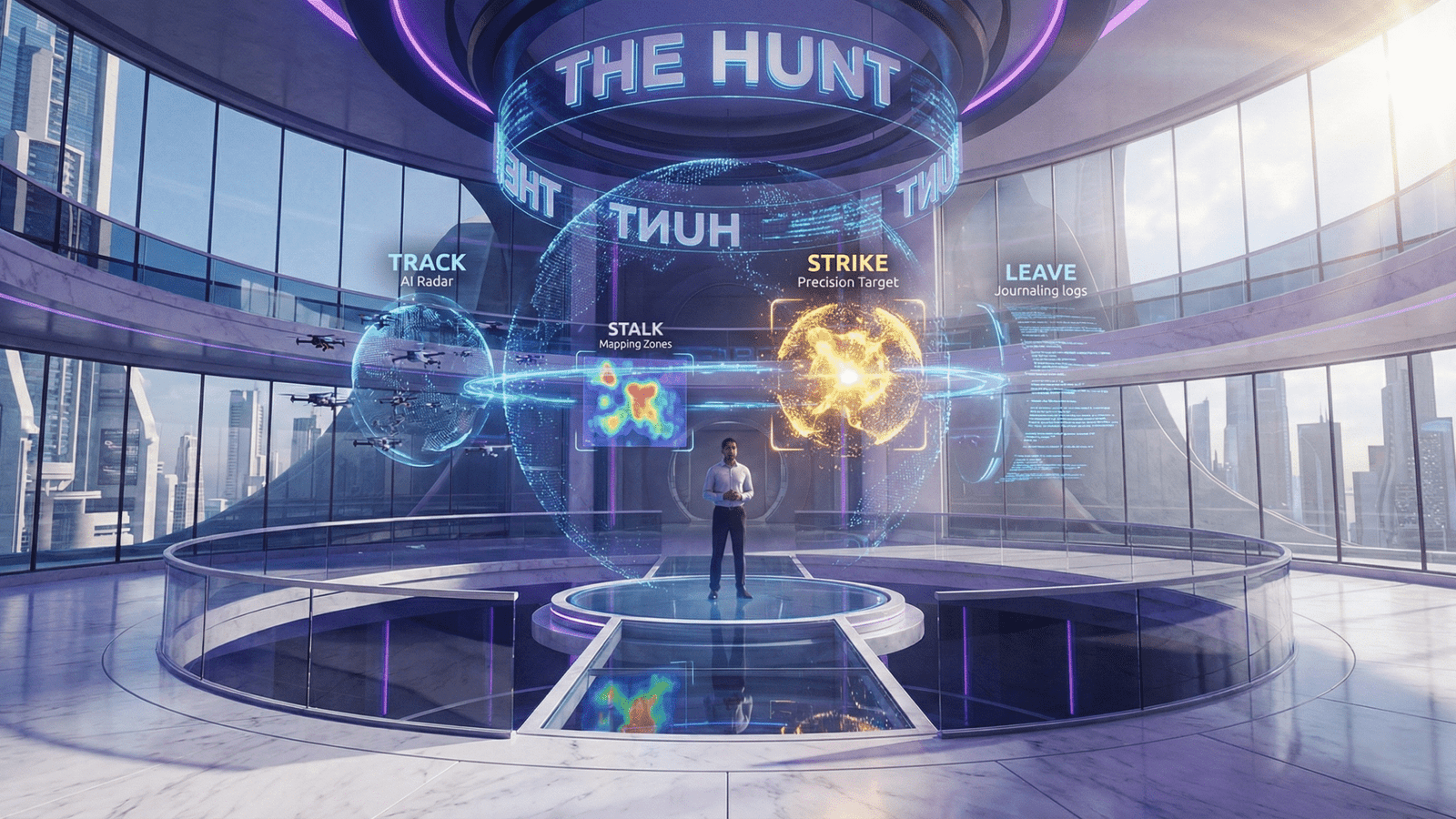

You have the theoretical knowledge. You can identify liquidity, structure, and order blocks perfectly after the fact. But in the live market, this knowledge creates hesitation instead of conviction, leading to missed opportunities and frustration.

Knowledge without execution becomes a barrier instead of an edge.