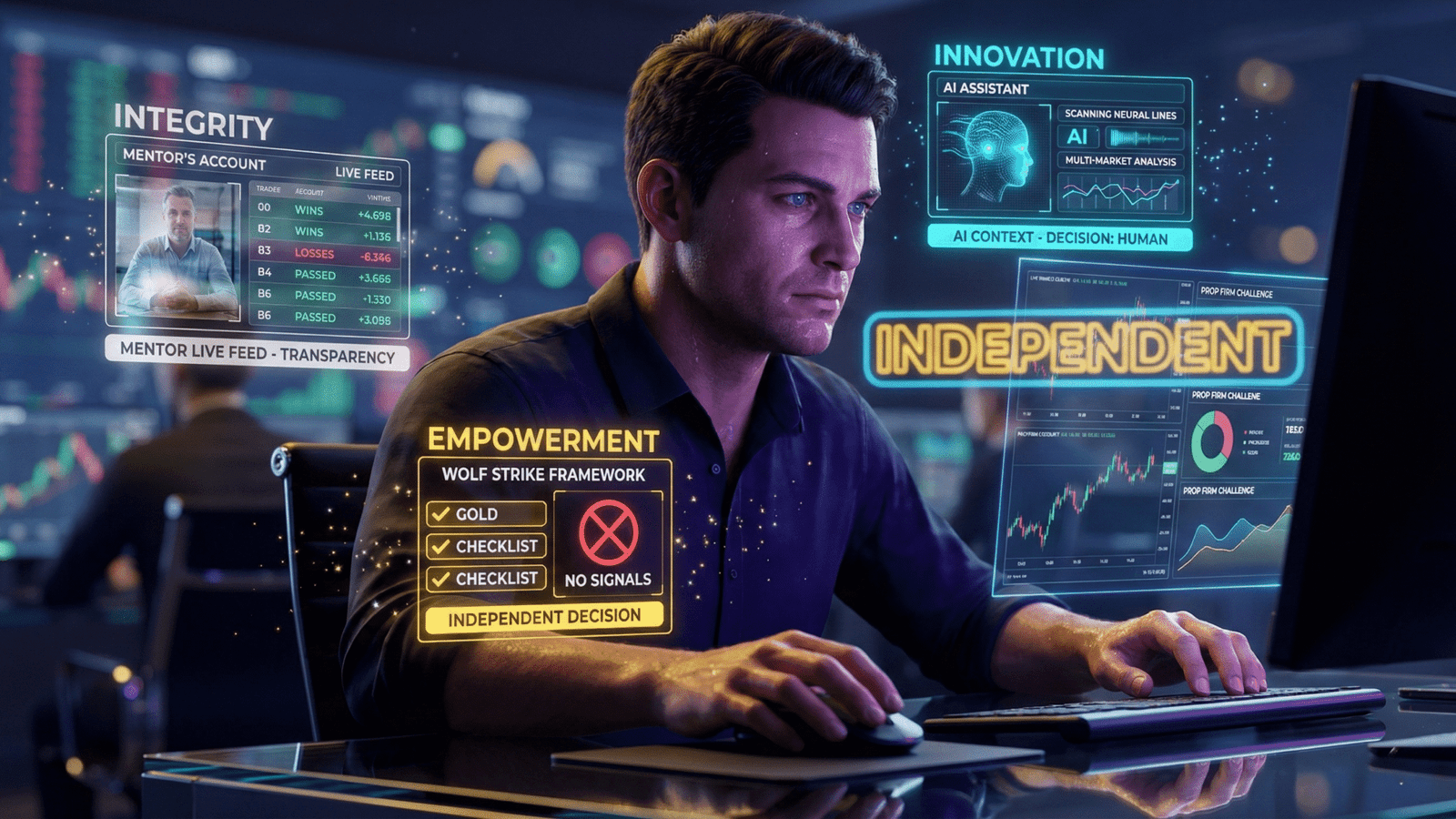

Integrity

We Teach What We Trade

We are not "gurus" who sell courses on theory we don't apply. This is not "hindsight theater". You see our full process—wins, losses, and passed trades—live, in real-time.

No course categories available.

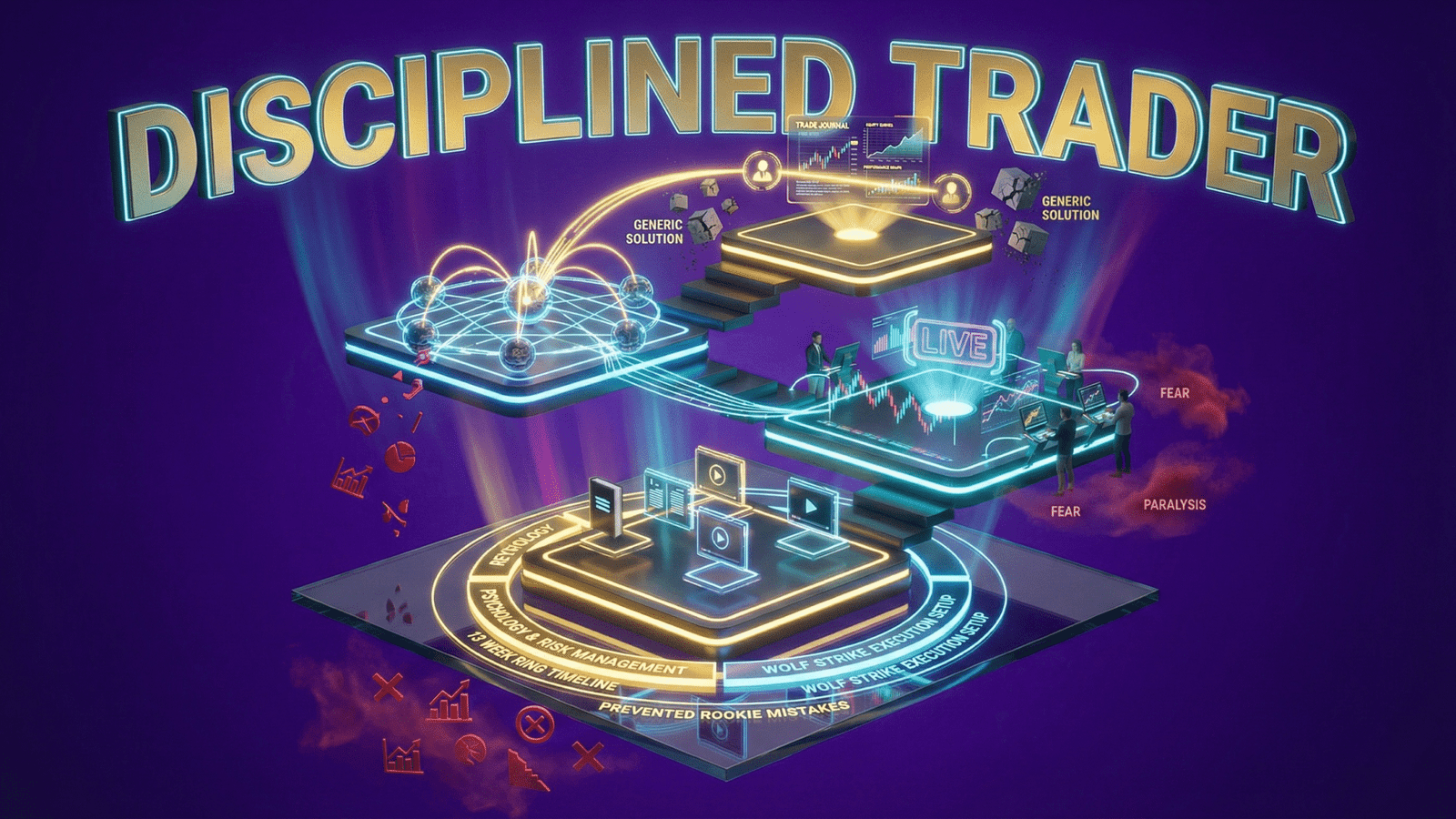

Join funded traders live. Mentees get lifetime access. Master a rules-first 1-minute trading system, sharpened by AI, engineered to get you prop-firm ready. Every action is a disciplined decision — not a guess.

Most failures aren’t from “not knowing indicators. You know the theory—SMC, ICT, Price Action, Dow Theory—and you can mark up a chart perfectly in hindsight. But when you’re in the live market, and your real money is on the line, something breaks. Impatience, fear, and greed take over. You break your rules, chase trades or cut winners short.

| PROBLEM | SWL FIX |

|---|---|

| Emotional entries & exits | Live rule-based execution system |

| No confluence / random trades | Structured AI-assisted workflow |

| Trading alone → no accountability | Live environment + real-time guidance |

| Paper confidence, live fear | Real execution repetitions with support |

| Burnout & inconsistent routine | 1–5m precision playbook & time windows |

The wolf embodies instinct, patience, teamwork, and strike precision. At Scalping Wolf Live, we believe real trading edge comes from acting with the team, learning to wait until the odds are right, and executing with calm confidence.

Scalping Wolf Live (SWL) is a UK-based trading education company founded in 2024 by

Raheel Ahmed Rathore. We are a mentorship-first platform focused on one outcome:

building prop-firm-ready traders.

We blend daily live trading sessions, AI-assisted analysis and a disciplined

1-minute scalping framework called ‘Wolf Strike Scalping’ to help traders master

the psychology and execution skills required for consistent success.

Scalping Wolf Live was born from failure.

Our founder, Raheel Rathore is a full-time, multi-account funded prop-firm trader He didn't start as a mentor but someone who rebuilt his fate. In 2024, he founded SWL to create the live, transparent, "do-it-with-me" learning environment he wished he'd had. He’s a Certified Fundamental Analyst, Certified Technical Analyst and Generative AI Expert with certifications from Google, NVIDIA, OpenAI, IBM and MIT.

Raheel started as a trader caught in the crypto hype cycle around Elon Musk's SNL appearance. He suffered a faster, devastating loss, wiping out a large portion of his personal savings in his early trading period.

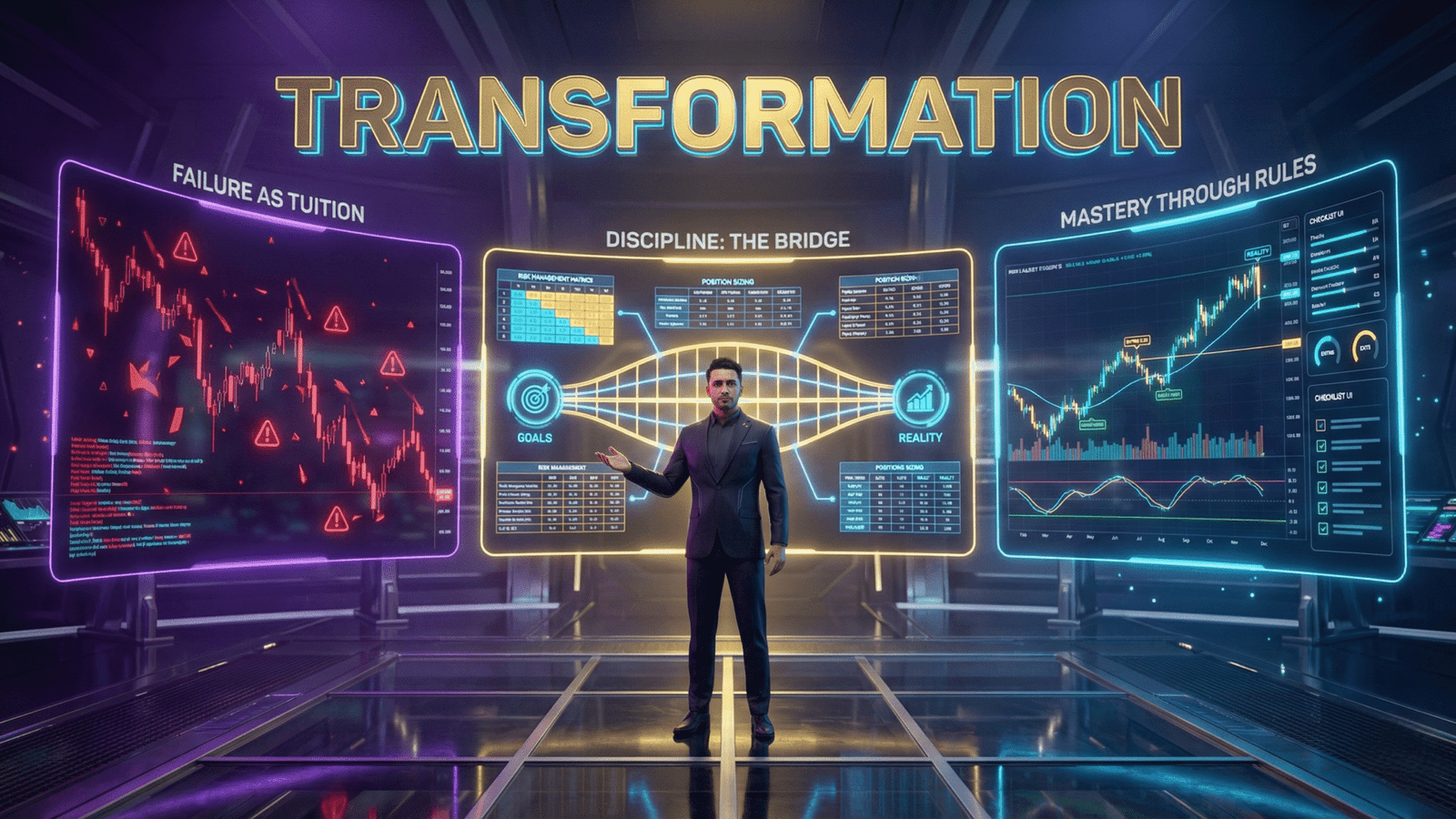

He became obsessed with figuring out why he had failed. He invested heavily in the trading education industry—online courses, offline seminars and private mentors. He studied everything: ICT, SMC, Price Action, Supply & Demand, and Wyckoff Theory. But the results were still inconsistent, failure. The analysis looked perfect on paper, but in the live market, he still struggled. He realized the real blocker wasn't a lack of knowledge; it was a lack of discipline and psychological control under pressure.

That was the turning point. He stopped "strategy-hopping" and began a relentless, first-principles rebuild, focusing on risk and psychology first. This journey was defined by deep, structured mentorship. Raheel extends his deepest gratitude to his technical analysis mentor, Syed Faraz, whose personal care and profound guidance were instrumental in his transformation—grooming him from a struggling trader into a full-time professional funded trader. This technical mastery was complemented by fundamental depth from Ammar Yasin, creating the complete, well-rounded approach that defines SWL today.

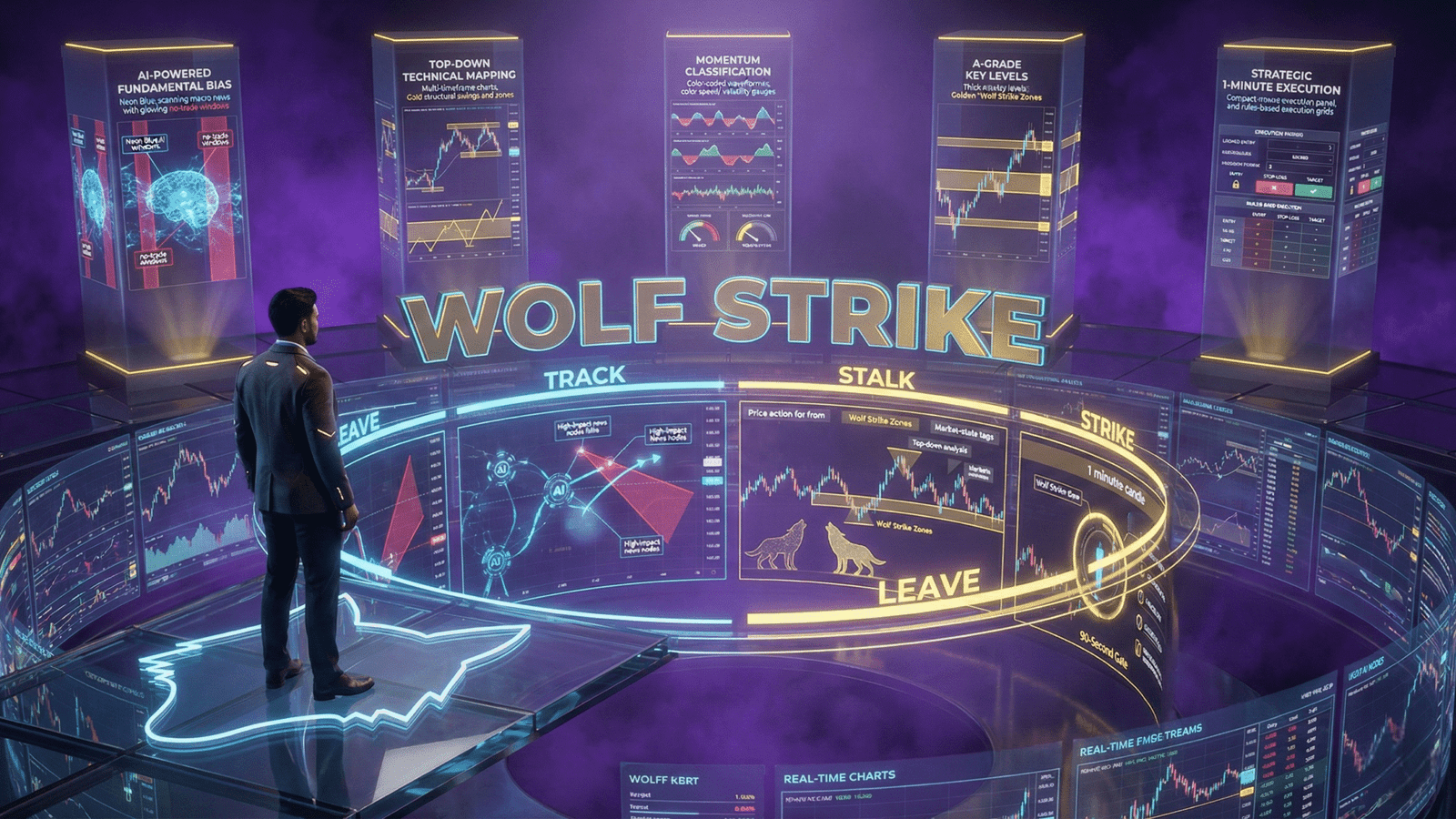

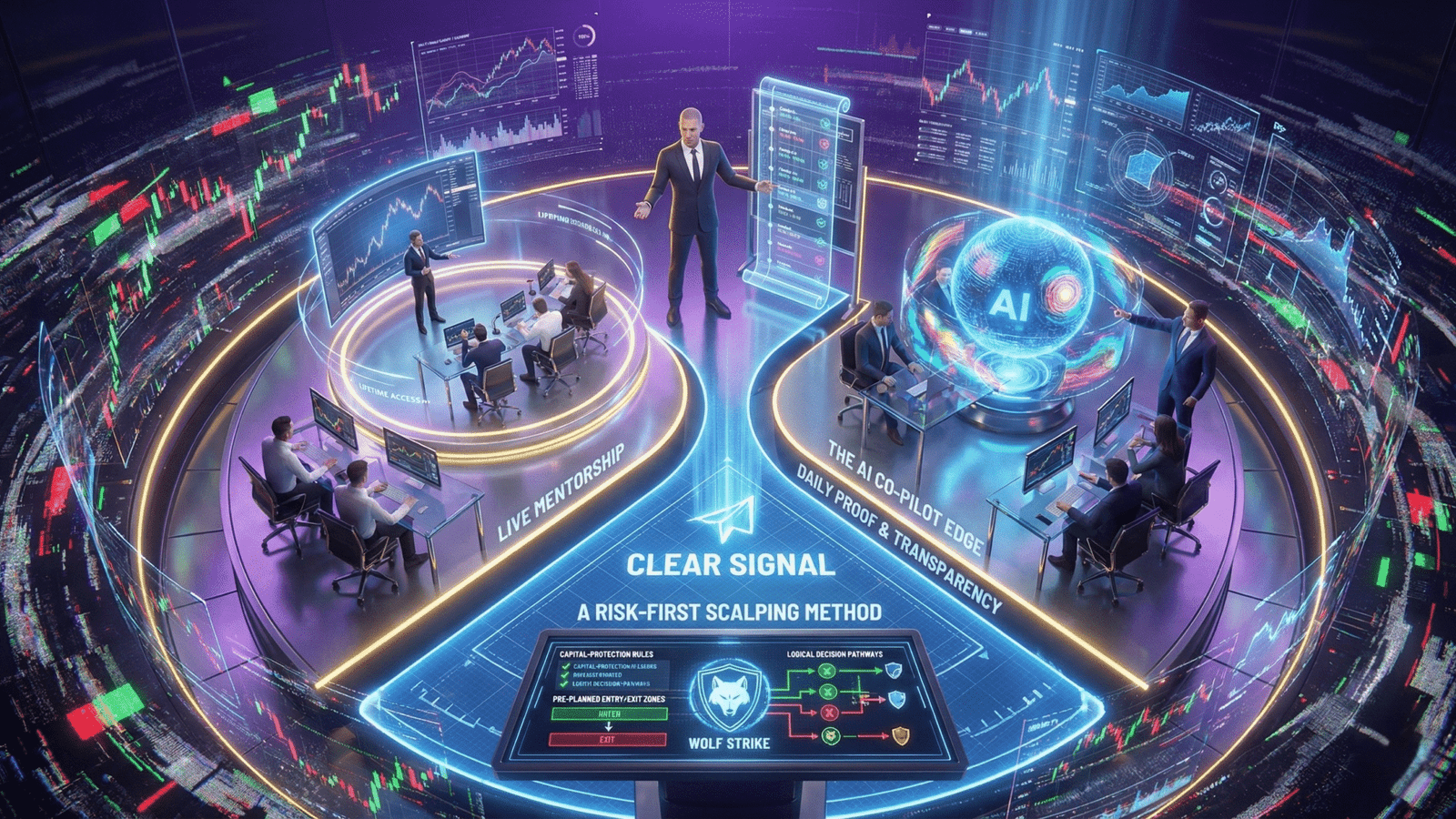

Wolf Strike Scalping is our proprietary rules-driven 1 minute trading strategy. You define risk clearly, execute precise entries, then close the loop with daily review.

It is engineered from the ground up to solve this problem. It is a complete, 6-pillar operating system that builds confluence, moving from a high-level fundamental bias down to a precise 1-minute execution. This is how it works:

| Pillar / Stage | Purpose | Tools & Techniques Used | Outcome / Edge |

|---|---|---|---|

| 1. AI-Powered Fundamental Analysis | Build directional bias based on macro drivers and high-impact news | AI-driven economic scanners, macro event filters, volatility trackers | Data-based clarity instead of emotional bias; traders trade with macro pulse |

| 2. Sentimental Analysis | Decode crowd psychology and positioning | Machine-scored social data, sentiment indices, open-interest heatmaps | Profiting from sentiment extremes and avoiding false momentum traps |

| 3. Multi-Time Frame Analysis | Contextual confirmation from macro to micro | Weekly → Daily → 15-Min → 1-Min mapping using price action zones | Ensures context, reduces random entries, improves consistency |

| 4. 1-Minute Precision Execution | Enter trades with razor precision using technical confluence | Real-time chart execution, limit orders, risk-to-reward ratios | Minimum emotional noise and low exposure risk through precision timing |

| 5. Continuous Feedback Loop | Reinforce discipline, adapt to evolving data | Daily live review sessions, trade journaling, group mentorship | Constant improvement — process-based growth, not outcome-chasing |

| 6. Psychological Calibration | Preserve mental focus and composure under volatility | Breathing drills, performance tracking, daily “state reset” protocols | Mastery of emotional neutrality during fast-paced trading |

| Step | Stage | Action | Goal |

|---|---|---|---|

| 1 | Scan | AI performs macro + sentiment scan pre-market | Builds fundamental bias |

| 2 | Align | Confirm Weekly–Daily–15m structure | Validates trade zones |

| 3 | Execute | Precision 1-min scalping entry | Tactical, low-risk trade |

| 4 | Manage | Real-time trailing, risk control, partial exits | Preserve capital, lock gains |

| 5 | Review | Post-session feedback and recap | Reinforce discipline daily |

“Clarity through structure. Precision through repetition. Mastery through discipline.”

– Raheel Ahmed Rathore

Our purpose is to fix the true blocker in trading: psychology under pressure. We exist to build disciplined, independent operators by providing a live, feedback-rich environment where risk rules and emotional control are mastered through daily, transparent practice.

To build prop-firm-ready traders by teaching the 'Wolf Strike Scalping' operating system—a disciplined method delivered through daily live practice, AI-powered analysis, and a permanent place in our live sessions to ensure habits are reinforced for life.

To be the most trusted global community where no trader is left to trade alone. A community anchored by lifetime live access, where traders master risk discipline, leverage AI insights, and achieve consistent, visible learning outcomes—trading smarter, together.

These are the four pillars we live by.

Integrity

We are not "gurus" who sell courses on theory we don't apply. This is not "hindsight theater". You see our full process—wins, losses, and passed trades—live, in real-time.

Empowerment

This is not a signals group. We are here to train independent decision-makers. We give you the framework and live feedback to stand on your own.

Innovation

We use AI as a powerful assistant to accelerate clarity and scan for context. But we keep humans in charge. Traders make the final judgment call.

We are mentors, analysts and moderators who share one obsession: repeatable discipline. We collaborate on checklists, drills, and debrief prompts so your practice is consistent across the week. We keep the room respectful, multilingual-aware and calm—because psychology under pressure improves faster in a quiet, rule-first environment.

This philosophy is not just taught — it is transferred through structured, live mentorship. We eliminate burnout and time-waste by guiding traders through a clear, efficient path to mastery. Our mentorship is built on three core components.

"This is the heartbeat of SWL — real-time execution, real-time learning. You ask questions live, see real decisions, review sessions daily, and build mastery through repetition."

"You receive our exclusive mentee-only AI prompts and workflow. Learn to scan news, detect catalysts, score sentiment, and build a macro-to-micro plan just like a professional trader."

"A complete A-to-Z program teaching Psychology, AI-Powered Fundamentals, and Advanced Technical Execution — reinforced daily inside the live room."

Our purpose is to fix the true blocker in trading: psychology under pressure. We exist to build disciplined, independent operators by providing a live, feedback-rich environment where risk rules and emotional control are mastered through daily, transparent practice.

Let's be perfectly clear: We are not an algorithmic “black-box” trading system. We do not sell signals.

We use Generative AI as a powerful co-pilot — a research assistant that scans massive

datasets in seconds, reduces cognitive load, and highlights key catalysts.

The human trader always makes the final decision.

This mirrors insights from MIT Sloan:

“AI’s true financial power lies in augmenting human intelligence — not replacing it.”

(MIT Sloan Management Review, Sep 12, 2023)

Highlighting high-impact events and identifying “risk windows” that traders must avoid.

AI generates potential if/then conditions for the session such as trend, range or shift scenarios.

Clarifies which instruments have fundamental catalysts that make them worth watching.

Flags unusual volatility or correlation shifts that signal hidden risk or opportunity.

Our AI model processes multi-timeframe charts, mathematical confluence and market structure in real-time.

AI presents a fully-scanned, data-driven high-probability setup — humans make the final call.

AI scans news, catalysts, volatility

Mentor validates & maps levels

Trader executes plan

Journal, grade, refine

Rules first. The trade comes second.

One behaviour per week. Protect it like capital.

Stop on plan. No “just one more.”

Review daily. One lesson, one fix.

Respect the capital. If conditions don’t align, we don’t trade.

What We Believe About Risk, Psychology, and the Power of Saying “No” Discipline is a skill, not a mood. Habits form through repeated context-specific action; automaticity grows with consistent repetition. This is what we believe. This is the core of our solution to the psychological problem of trading. We believe the market is a battlefield, and the primary battle is not with the charts; it's with yourself—your fear, your greed, and your impatience. We don’t chase novelty; we chase repeatability. We don’t promise outcomes; we promise a cleaner process.

(Prep → Execute → Review)

We convert theory into consistent execution with a structured daily learning cycle. This operating rhythm builds disciplined, professional habits.

This is our “Track” and “Stalk” phase. We don’t guess; we prepare.

This is our “Strike” phase.

This is our “Learn” phase — consolidation and refinement.

This mentorship is built for a specific type of trader — and we fiercely protect the focus of our community.

Insights From The Edge of Tomorrow

Why Bitcoin and major altcoins move in repeating psychological and technical cycles — and how traders can position themselves smartly.

Read More →

Machine learning is redefining how traders analyze volatility, momentum, and on-chain behavior across the cryptocurrency markets.

Read More →

From private keys to decentralized protocols, here’s what every crypto trader should understand about protecting digital wealth.

Read More →