Understanding Crypto Market Cycles

Why Bitcoin and major altcoins move in repeating psychological and technical cycles — and how traders can position themselves smartly.

Read More →No course categories available.

Prop trading is a career path where traders use a firm's capital instead of personal savings. By successfully passing a "Prop Firm Challenge" (a structured evaluation of skill and risk management), qualified traders gain access to funded accounts ranging from $50,000 to $200,000, typically keeping up to 80-90% of the profits generated. However, this industry acts as a rigorous filter: firms like FTMO, Alpha Capital Group, TopStep and The5ers are seeking disciplined risk managers, not gamblers.

Most retail traders view prop trading as "easy money" or a "get rich quick" scheme. They miss the harsh reality: Prop trading is the hardest test of psychological discipline you will ever face. If you treat it like a casino, you will fail. If you treat it like a business—with strict rules, mechanical execution, and a respect for capital—you can secure a full-time income without risking your life's savings. At Scalping Wolf Live, we exist to bridge the gap between "paper knowledge" and the live execution required to pass these challenges.

In personal trading, you're limited by your savings and bear 100% liability. Prop trading lets you leverage institutional funds after a small evaluation fee, offering asymmetric risk-reward.

The fundamental difference lies in leverage and liability. In a personal account, you are limited by your own savings, and every loss reduces your net worth. In prop trading, you leverage institutional funds after paying a small, one-time evaluation fee.

The standard route to funding involves a two-phase evaluation designed to prove you have a statistical edge and emotional control.

| Feature | Personal Trading | Prop Firm Trading |

|---|---|---|

| Capital Source | Your Life Savings | The Firm's Capital |

| Risk Liability | 100% Personal (Unlimited) | Evaluation Fee Only (Capped) |

| Scaling | Slow (Years) | Fast (Instant $100k+) |

| Psych Load | Fear of losing rent | Performance pressure |

Traders pursue prop trading to solve the "under-capitalization trap." Many skilled traders fail not because they lack strategy, but because they are trading accounts so small that they are forced to over-leverage to see meaningful returns.

This career path is about Capital Efficiency.

The "Prop-Firm Paradox" is a painful cycle where traders buy a challenge, rush to hit the profit target, make an emotional mistake, fail, and repeat. Most failures aren't from "not knowing indicators." You know the theory—SMC, ICT, Price Action. But when real money is on the line, impatience takes over.

The #1 killer. You lose 2%, try to "make it back" quickly, and hit the 5% daily limit.

Trading blindly during news causes slippage that breaches your drawdown limit instantly.

The "rush" to hit 10% forces B-grade setups, leading to over-trading and burnout.

Holding a losing trade violates drawdown rules, even if the trade isn't closed yet.

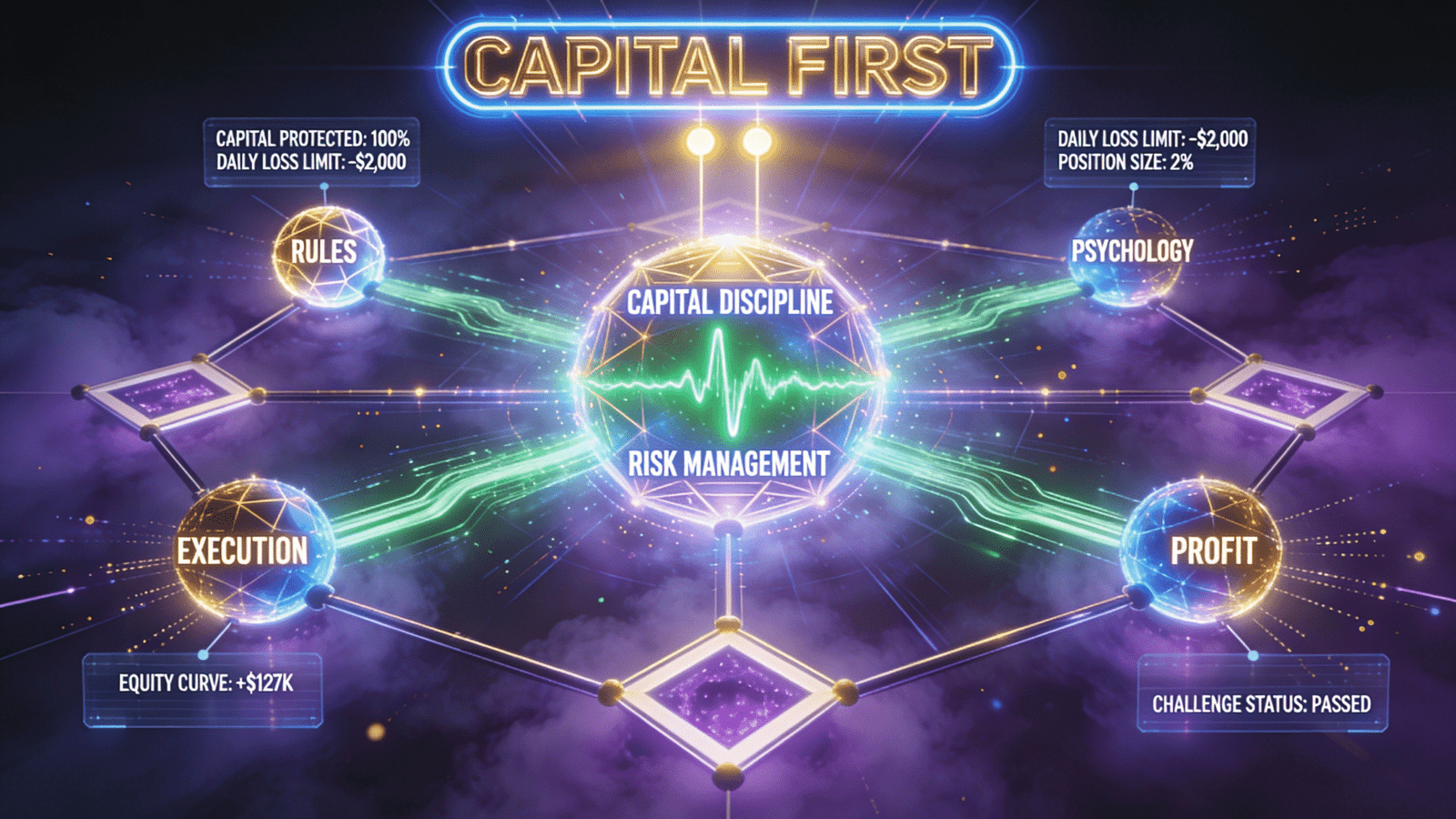

While firms like FTMO, The5ers and Alpha Capital differ, the core "Risk Rules" are universal. Mastering these is non-negotiable.

| Rule | The Risk / Trap | Wolf Solution |

|---|---|---|

| Max Daily Loss | Immediate termination. | Risk-First calculation pre-entry. |

| Profit Target | Over-leveraging rush. | Process Focus: Trade the setup. |

| News Trading | Slippage failures. | AI No-Trade Windows. |

| The Problem (Pain) | The Fix (Our Solution) |

|---|---|

| Theory overload | Live trading / learn by doing. |

| Emotional decisions | Discipline taught in-session. |

| No real-time feedback | Personal mentorship + live Q&A. |

| Poor precision | 1-minute execution rules. |

If you failed a challenge, do not buy another one immediately. Use the "Five Whys" to find the root cause—it is rarely the strategy.

Drawdown breach.

Over-leveraged.

Revenge trading.

No checklist.

No Process.

The Solution: You need a new operating system. SCALPING WOLF LIVE provides the Wolf Strike framework and the 90-Second Gate to break this cycle.

We believe the market is a battlefield, and the primary battle is not with the charts; it's with yourself—your fear, your greed, and your impatience. Discipline is a skill, not a mood. automaticity grows with consistent repetition.

Successful preparation requires a routine that mimics strict rules. We teach a specific operating system designed to withstand evaluation pressure.

Mandatory checklist. If one box (Volatility, Structure, Risk) fails, the trade does not exist.

AI EDGE scans for "No-Trade Windows." We explicitly stand down during high-risk events.

We Match Consistency with Live Execution and Psychological Pressure with The Pack.

Wolf Strike Scalping is our proprietary rules-driven 1-minute trading strategy. It turns chaotic price chasing into a patient, predatory hunt.

Surgical M1 entry points.

Fastest possible learning loop.

Focused sessions to avoid burnout.

| Pillar | Purpose | Edge |

|---|---|---|

| AI Fundamental | Macro drivers | Data-based clarity. |

| Sentimental | Crowd psychology | Avoid traps. |

| MTF Analysis | Contextual bias | Confirms direction. |

| Precision | Razor execution | Low risk entries. |

| Feedback | Discipline growth | Process reinforcement. |

| Calibration | Mental state | Emotional neutrality. |

Scalping Wolf Live uses a "Glass Box" philosophy: AI Scans, Humans Decide. AI reduces cognitive load and presents hypotheses—but you make the final call.

We convert theory into consistent execution with a daily learning cycle: Track & Stalk, Strike, and Leave. Stop trading to "make money" and start trading to "defend capital."

| Step | Stage | Action | Goal |

|---|---|---|---|

| 1 | Scan | AI macro + sentiment | Fundamental bias. |

| 2 | Align | Confirm structure | Validates zones. |

| 3 | Execute | 90-Sec Gate entry | Low-risk trade. |

| 4 | Manage | Real-time trailing | Preserve capital. |

| 5 | Review | Post-session recap | Reinforce discipline. |

Raheel Ahmed Rathore rebuilt his fate by fixing risk and psychology first. We are building a community of disciplined operators.

Passed his FTMO challenge on the first try using Wolf Strike. "I found a process, not a magic indicator."

Broke the revenge trading cycle through psychological coaching and respecting the capital.

Insights From The Edge of Tomorrow

Why Bitcoin and major altcoins move in repeating psychological and technical cycles — and how traders can position themselves smartly.

Read More →

Machine learning is redefining how traders analyze volatility, momentum, and on-chain behavior across the cryptocurrency markets.

Read More →

From private keys to decentralized protocols, here’s what every crypto trader should understand about protecting digital wealth.

Read More →